“We do not have money for payroll.” And a vendor is holding a delivery needed to satisfy our best customer, pending payment of a large invoice. “Thank God it’s only Tuesday.” Is this a scenario you have experienced? Or one you want to make sure to avoid? If so, read more to determine how you can steer clear of what I experienced over 10-years ago.

Situations like the one above may cause you to be overwhelmed and make focusing difficult. It’s time to breathe, refrain from panic and identify ways in which the situation can be resolved. During moments like these, you need to identify how to bring cash in quickly.

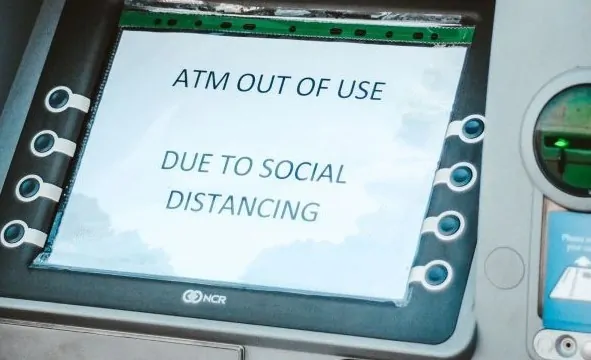

That’s life working at a company in crisis. “Cash is king” is a long-held maxim and from what I am hearing, never more true than during these times. Business executives know that lack of cash flow will doom a business much faster than lack of profitability.

Regardless of your company’s financial state during this highly uncertain period, it is critical that you manage your cash well. Things can change quickly. The quality of your cash management will determine whether you survive, let alone thrive.

Requiring a combination of critical thinking, strategy, and salesmanship, successfully minding a company’s cash entails a surprising amount of non-financial skill.

Determine Sources of Cash

As certain ways to increase your cash position. These include collecting past due receivables, selling short-term investments, excess inventory, underutilized vehicles and equipment, and expediting favorable insurance audits that will return money to the company, are just a few amongst others.

Reduce Cash Demands

Negotiate existing expenses down. Determine functions that can be moved in-house or eliminated. Rank your expenditures by amount, frequency, and timing. Evaluate the necessity of every expense. Start with the largest ones having the greatest impact. Decide what is needed to drive short term revenues and cut anything that does not; “no sacred cows.” Focus on non-personnel expenses first. This will send an important message to your team about what you value most.

Unfortunately, people related expenses typically account for the top 1 or 2 financial obligations of a company. Therefore, seeking ways to reduce these often become critical too. Eliminate perks, suspend 401(k) employer matches, reduce owner and/or associate salaries, move associates from full-time to part-time, or to a 1099 contractor, or lay people off, are some of the options you can employ.

Consider deeply how your decisions affect your people. Do not take them lightly and do what is required for the longevity of the firm. Think through your options thoroughly, challenge your assumptions and play out the scenarios of each choice. Make the best decisions you can, exhibit leadership and take responsibility for them. This is hard, get support.

Manage Your Payables

Trade credit is one of the most widely used sources of cash in business. Work with your vendors to maintain the maximum credit available, while extending payments out as much as possible. Open new vendor accounts to expand credit capacity. Be prepared for unexpected changes and develop contingency plans.

A company having difficulty meeting its obligations will have to strategize how vendors will be paid and when. Refrain from making commitments you cannot meet. Communicate with vendors, even when you cannot give them the answers they want. Your relationships will be key to keeping credit lines open and as high as possible.Extending

Extending Trade Credit

Decide on your philosophy for extending trade credit during a crisis. Will you demand on-time payment or provide flexibility? Will you reduce credit limits or keep them the same? Require new disclosure requirements and guarantees?

Rank your customers by sales volume, credit worthiness and payment performance. Consider the risks posed by both the default of large customers, as well as the cumulative impact of the default a series of smaller ones. Remember, failing to get paid is one of the fastest ways to go out of business.

Banking Relationships

Keep in mind that the number one concern of bankers is how and when they are going to get paid. Therefore, bankers are most interested in extending credit to companies when they do not need it and may hesitate or decline to do so when they do. Do not knock bankers for this mindset. It is how they stay in business.

Invest thoughtfully in your banking relationships. Develop rapport with the decision makers. Make sure to communicate with candor, assurance, and positivity, as your demeanor with them is important. Do not offer more information than they require. Consider getting coached on this.

Key Take-aways

1. Refrain from panic, things change quickly, focus on cash flow.

2. Cut all nonessential expenses, no sacred cows, respect people.

3. Develop and adhere to strategies to manage and extend credit.

4. Invest in relationships, maintain integrity, use persuasion and humor.

5. Exhibit leadership, take responsibility, exhibit self-care, and get support.

During crises, developing and maintaining trusted relationships are especially critical. Do your best. Stay true to yourself. Do not hide. Treat yourself and others with compassion as you strive to achieve your goals.

These times bring up a lot of anxiety, worry and concern for the employees and the company’s future. It can be hard to go through this objectively. Consider getting help developing and support executing plans to meet these challenges.

Stay safe and be well.

Robert Hackman is the founder and principal of 4C Consulting, an Executive Coaching and Consulting company that helps companies and their people retain and restore trust during a pandemic.

He can be reached by voice or text at 484.800.2203, or email at rhackman@4cconsulting.net, https://4consulting.net.

Picture 1 by Mathias Muller on Pixabay

Picture 2 by @helloimnik on Unsplash